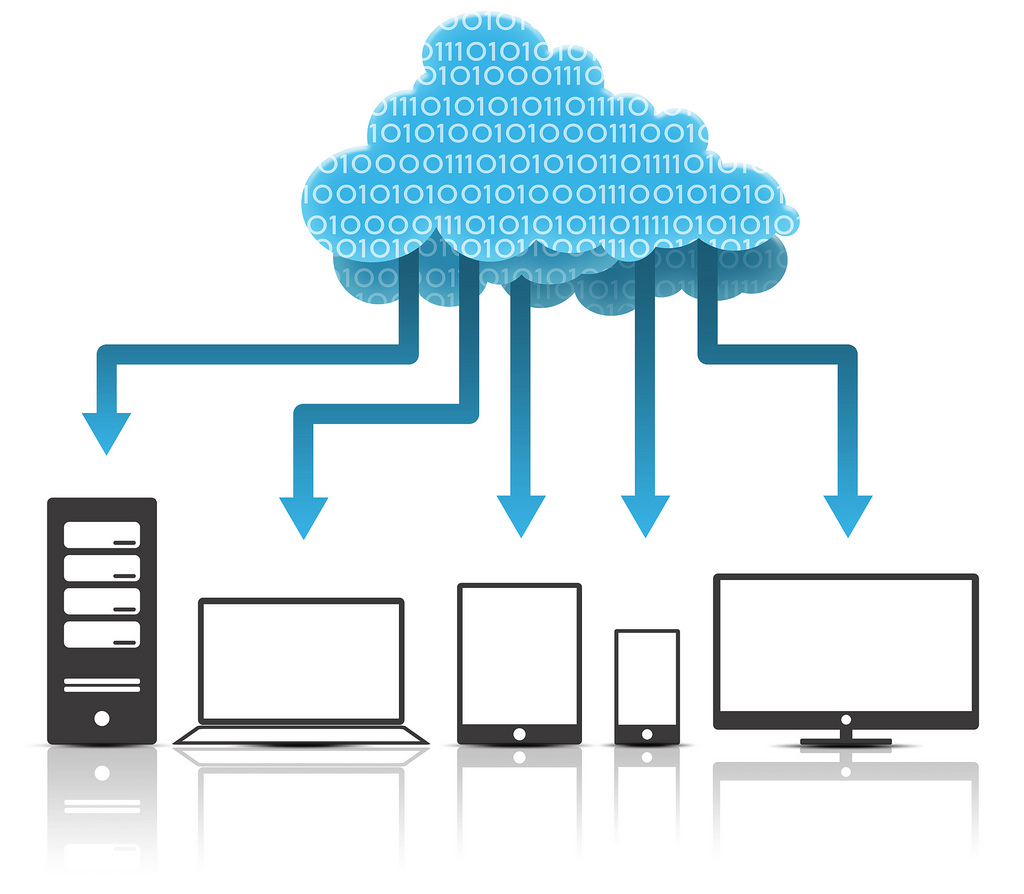

Our administration services is dynamically linked to our portals that share data on a common rail including workflow, query management, transition, document management and file transport.

Triple A Super was formed in 2006 to address the specific needs of Self-Managed Super Funds using a combination of leading technology, skilled experienced people and the desire to become a leading SMSF administrator of quality.

From the outset, the business was positioned to service two principal market segments- accountants and financial advisers.

The key people at Triple A Super have collectively over 100 years’ experience in SMSF, Corporate Superannuation, Industry Fund, Dealer Groups and Accounting.

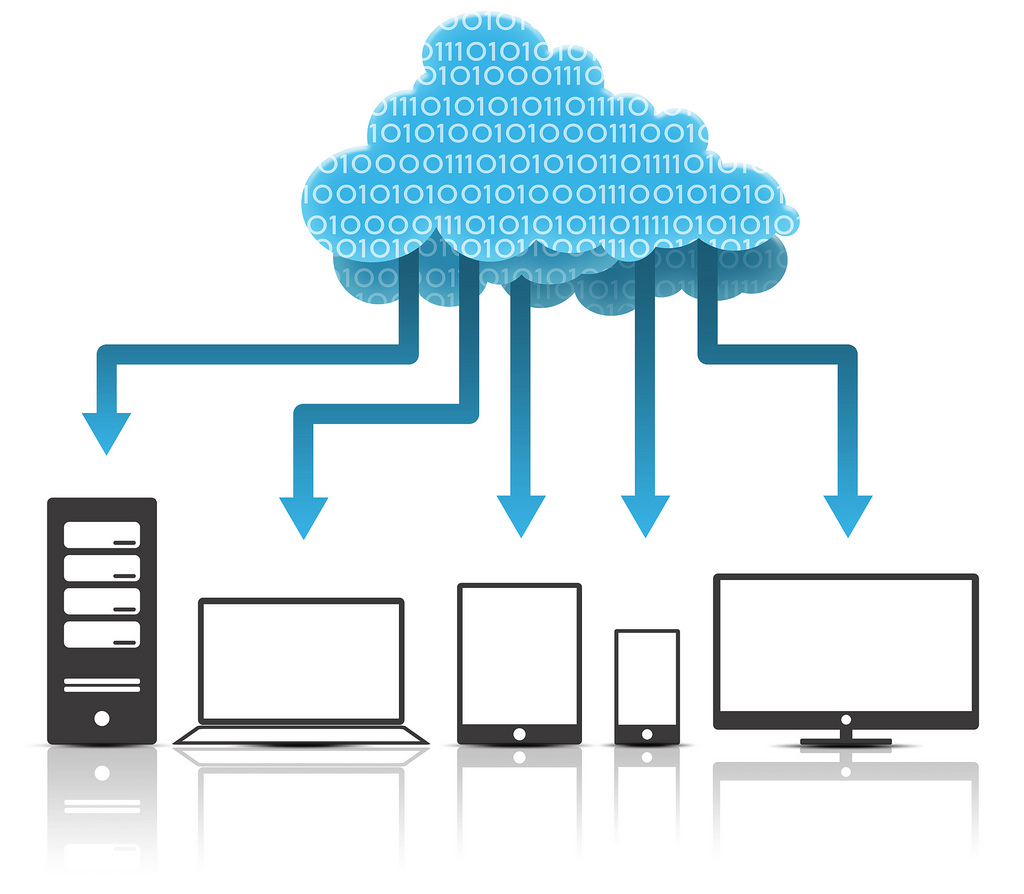

Triple A Super distinguishes itself through innovation derived from our own inhouse technology that seamlessly integrates with the key SMSF administration software providers.

Our development is powered by Oracle with whom we have a close working relationship.

Today, we have two operating units being Information Technology with a key focus on Robotic Process Automation and Accounting where our services are delivered.

2006

Qualified SMSF Skilled Staff

Enhancing client experience

Increasing client connectivity

Our administration services is dynamically linked to our portals that share data on a common rail including workflow, query management, transition, document management and file transport.

Dashboard - As part of the digital experience, the portals directly link through to each fund and adviser dashboard to capture a whole of client view including continuous oversight of key compliance and investment metrics.

All work is performed by qualified and experienced staff.

Each client has its own dedicated client relationship manager.

Accountants - A completely anonymous “White Label” administration service is the predominant service required by Accountants. It encompasses:

End of Year administration, Overflow or Emergency administration assistance all provided on the administration software system chosen by the accounting firm. The above service model is also available to advisers depending on need.

Financial Advisers - You can select from three levels of service: Digital for fully data fed investments, Enhanced for all investments and Premium for all types of investments and a concierge driven service.

The key systems we use are Class and BGL.

We do not make contact directly with trustees to ensure the relationship you have with your clients is not disrupted.

We do not accept commissions or rebates and are not aligned with other financial institutions that will conflict with your business.

Deed & Other services - Deed Services are provided on a marginal cost basis. Other services are available through your client relationship manager including Technical Advice, Taxation, Regulatory, ASIC, and Non Super requirements.

The use of integrated technology, not just the use of the administration software itself is the defining difference between providers.

The five degrees of separation between us and our competitors is our technology footprint. This innovation associated with its implementation to carry the financial advisers and accountants more deeply into a digitised world is what distinguishes Triple A Super in the market place.

It is surfaced through a Smart Dashboard.

One of the key benefits of using Triple A Super is the synchronised technology solutions that manage data from input to reporting. Embedded analytics, key investment data, document management and direct connectivity to the fund accountant increase operational efficiency in the hands of the adviser through a Smart Dashboard.

Designed to increase client engagement, the Smart Dashboard provides a comprehensive overview and landscape of all matters relating to each SMSF. Operational data is rolled up in an Adviser dashboard for quick analysis of alerts, follow ups and opportunities to maximise revenue per fund. Click “here” to view the video outlining the features, depth and capabilities of the dashboard.